Quick dive into alternative protein/sustainable food sector

a brief concept note primarily from India lens and learnings from global trend

Welcome, DCs. It’s been a while. Today I’ll attempt to teleport you all to an alternate universe. Web3? No, we’ll touch upon it soon.

This time we’ll DoubleClick on proteinverse. Let’s start with:

Topics at a Glance:

Problem statement

Solution

Market size, sector trend, and growth outlook

Value chain and components

Business model

Unit economics

Domestic play

Global play

Funding and active investors

Closing words*

Note: This is written from India perspective along with the learnings from the global trend

Problem statement

Population: In 2018, the global population was ~7.6 bn and is projected to reach ~10 bn by 2050 [1]. Sustaining these people will require a massive amount of food. 50% of the harvest is used in feeding livestock and only 37% is grown purely for human consumption. The global agriculture and meat industry face enormous challenges to meet the growing demand for meat while transforming into a more sustainable structure.

Resources: The ratio of arable land has decreased from 0.38 to 0.15 hectares per head, while global agriculture already uses about 70% of blue water. Animal agriculture takes 33-40% of total arable land[2].

Protein deficiency: 73% of Indians are deficient in protein while above 90% are unaware of the daily requirement of protein. Globally, protein consumption is on the rise, averaging at 68 gm per person per day. India has the lowest average protein consumption at 47 gm per person per day as compared to other asian countries as well as developed nations.[3]

Lactose intolerance: Global prevalence estimate at ~68% and India at ~61% are lactose intolerant, which means these people cannot digest lactose[4].

GHG emission: India’s meat market is projected to grow rapidly backed by a gradual increase in per capita income. The drastic consumption habit has a risk of un-regulated animal farming resulting in an increase in GHG emission. India emitted 2,299 MT of CO2 in 2018 which accounts for 7% of global GHG emissions. Agriculture and livestock account for 18% of gross national emissions[5]. Cow emits up to 500L of methane per day.

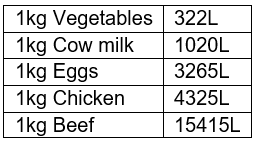

Water footprint:[6]

Solution

Plant-based meat takes 47–99% less land, 30-90% less GHG emission, 72-99% less water and causes 51-91% less aquatic nutrient pollution compared to conventional meat[7].

The conventional meat sector produces 10-25% conversion grain to meat. Comparatively, plant-based meat provides a conversion rate of about 70-75% with the same nutritional profile[8].

The meat value chain could be simplified dramatically, as “clean meat” labs could take the place of farms, feedlots, and slaughterhouses.

The sector is poised to play an important role in building a resilient protein supply chain.

Market size, sector trend and growth outlook

Segmentation

Plant-based Meat, Milk, Egg

Cell-based: Very nascent. Technological underpinnings provide greater IP protection. Regulatory approval by USDA and FDA will play an important aspect[9].

Global

The conventional meat industry is valued at $1tn (excl. retail value add.).

The alternative meat sector is expected to grow from 1% of the total meat market to ~28% (driven by plant-based CAGR @10-20%) over the next decade and capture ~60% (driven by cell-based starting 2028-30 CAGR @ more than 35%) by 2040 [10]

India

In 2019, India’s meat market size was valued at $45-50bn and projected to reach $65-70bn (CAGR @7%)[11]. Dairy market size valued at $140bn has historically grown at ~12% driven majorly by value-added products[12].

The plant-based meat market size is valued at $30-40mn and is expected to reach $500mn in the next 3 years (>100% CAGR)[13]. The plant-based dairy (soy, almond, oat milk) of $20mn is projected to grow to $60mn (>25% CAGR)[14]

WEF predicts India will spend an additional $1.6tn by 2030 on aspirational and healthier food

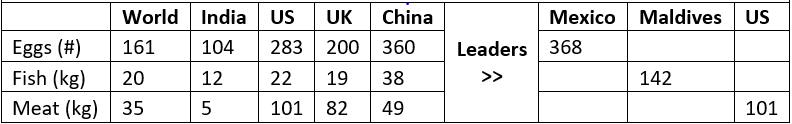

Per Capita/per person[15]

Target customers are primarily flexitarian/omnivores with source of protein pitch vs fake meat. They prefer alternative protein products primarily for environmental and health reasons.

Alternate meat 1.0 was mostly consumed by vegetarians (Soya chunks, Tofu, Tempeh). However, Alternate meat 2.0 provides for a technological breakthrough on taste, sensory and affordability disrupting the conventional meat audience as well.

India 2011 census-based NSSO survey states 70-75% are non-vegetarians. Frontier Survey findings show ~63% of Indians are extremely likely to purchase plant-based meat.

The fundamental drivers for the growth of the plant-based meat sector are an increasing vegan population, technological advancements, health problems, and most importantly, changing consumers' perception towards sustainability.

Value chain and components

Source >> Extraction >> Formulation & Processing >> Brand

Current portfolios:

Sourcing: soya, pea, wheat, moong, chickpeas, millets, potato, fava beans, rice bran, hemp seed, jack-fruit, corn, maize, mushroom

Final product (fresh and frozen): patty, nuggets, popcorn, curry, chunks, hot dog, sausage, kebabs, keema, meatballs, drumsticks, fillets

USP

Patents: Players with enough protective IP beyond the brand (process innovation and extrusion capability across ingredient and formulation) to provide a defensible moat.

New products and versatility: Going beyond burgers and offering products that align with local palate including products used in recipes.

India cost advantage: Benefit of Land and labour optimization in setting a selling price.

Branding and positioning: This will play a vital role as only meat-free or healthy marketing won’t appeal to a meat audience. There is a need to double down on the community of believers, investors and influencers to drive conscious consumption.

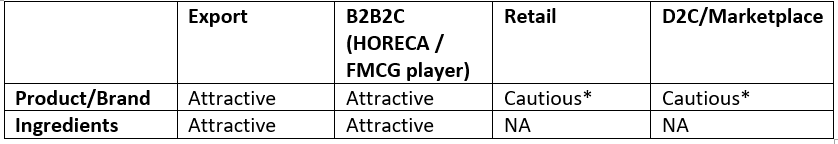

Business model

*due to India’s current level of adoption and need for behavioural change. Online meat brands are sweetly positioned to disrupt.

Unit economics

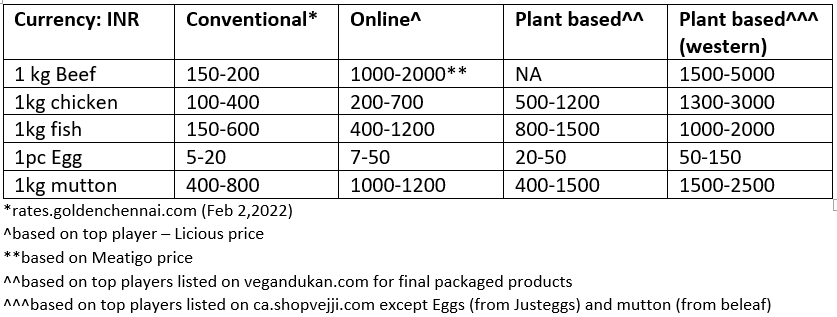

Broad Price comparison for a range of products available in each category (India)

25-50% Gross margin (top players make around this much).

Domestic play

Product/Brands (Gooddot, Bluetribe, GoodMylk, Evo Foods) & Ingredients (Proeon, Supplant)

Gooddot has been at the forefront in India building the category and breaking barriers in terms of taste, price, shelf stability. The customers need cooking guidance and hence they started QSR for ready to eat meals. Successfully cracking the flavour profile, they are going aggressive in export markets as well. Evo Foods’s liquid eggs are fluffier and healthier than normal eggs.

Ingredient players focus on building supply chain infrastructure by solving for current plant-based protein ingredients on right material supply, poor nutritional and digestibility, organoleptic (taste and texture properties), processing ability (Solubility), extrusion issues.

Online meat vertical players (Licious, Zaapfresh, Freshtohome, Meatigo) and horizontal players (Bigbasket, Swiggy)

Online is less than 1% of the overall meat market valued between $100-130mn. The vast majority of the Indian meat industry is unorganized. ~90% of the supply comes from the unorganized wet markets & mandis[16]

80% is captured by the vertical players[17]. The supply chain is very complex, distinct regionally and along with high-quality hygienic products become a barrier to entry. The market is being organised with aggregators and brands. The players aim to continuously invest in supply chain and technology platforms as well as increase product portfolio.

While many new plant-based meat start-ups are already selling through horizontal players, Licious and Freshtohome plan to double down on their existing customer base by adding a portfolio of plant-based meat products.

The plant-based sector has captured the attention of FMCG players in India as well. Epigamia launched plant-based yoghurt made of coconut milk in 2020. Over the last 6 months, the sector witnessed the entry of ITC and Japan’s Next Meat.

Global play

Products (Beyond meat, Impossible food, Good Catch, Memphis, Mosameat, Omnipork, JustEgg, Oatly) and Ingredients (Nepra, Motifworks, Ingredion, Innovopro)

Beyond meats primarily relied on retail and small restaurant operators while impossible foods forge strategic partnerships with restaurant/QSR chains resulting in steady growth. Impossible foods leverage molecular engineering and usage of hemp to create “bleeding” and “meaty” plant-based burgers which have proved to be indistinguishable from real meat.

Memphis (Upsidefood) produces cell-based meat and claims to use 1% land and water. They are constantly reducing costs to compete with conventional meat. While the original cost of beef at $18K per pound and poultry at $9K per pound has come down to $2.4K per pound by 2018, this is anticipated to decline further with the commercial release[18].

Conventional meat/food players are betting on new protein sources by launching either a dedicated business line or through strategic investment or setting up a corporate venture arm.

JBS (Planterra Food), Tyson (Raised & Rooted + Memphis, Future meat), Cargill (Aleph Farms + Memphis), Conagra (Gardein), Unilever (Vegetarian Butcher), Danone (Alpro + Earth Island), Smithfield (Pure Farmlands), Nestle (Harvest Gourmet), Maple Leaf Food (Greenleaf food), Kellogg (Morningstar farms)

Meat producers are changing their erstwhile core identities. They no longer position themselves as “meat companies” but, instead, as “protein companies”

Marquee QSR players provide a strategic distribution advantage. McDonald’s, Burger King, KFC, Pizza Hut, Starbucks, Dominos have partnered with alternate meat players to co-brand/add plant-based meat products to their menu.

Funding and active Investors

Globally the sector has attracted over $3.5 billion in venture capital in 2021 (following $3.1 billion in 2020), indicating that investors and consumers worldwide are warming up to the idea of conscious consumption[19].

Unovis, New Crop Capital, Stray Dog, Blue Horizon, Collaborative fund, Evolution VC, Blackstone, Thrive, ProVeg, Rabo, GGV, Happiness capital, S2G ventures, Agfundr, Temasek

Closing words*

Being the sunrise sector, there is an extremely high need for founder market fit (food/protein scientist, entrepreneur). Entering at pre-series A or Series A (co-investing with an active investor in this segment) for identifying the right founder and business mix to capture upside.

Global outlook: There is clear visibility of adoption. GFI report estimates a requirement of ~$40bn of investment in infrastructure and operating cost by 2030 to fulfil the projected demand.

India outlook:

Nascent stage, brand play will need capital for category creation. Start-ups can take the route of Ingredient segment or brand play focused on exports (giving price arbitrage).

Acquiring customers/adoption: Cooking is an important part for the right taste and ultimately adoption. RTE / QSR push / Cloud-based kitchen should see tremendous traction. Online meat brands already have the data of the target audience and are uniquely positioned to storm retail/DTC channels.

Different market: India prefers spicy, masala-based dishes and is price-conscious. The product should blend, suited to homegrown dishes in order to satisfy the local palate and be priced accordingly.

*my personal views and shouldn’t be considered as any kind of advice

That’s a wrap-up! but wait…

One Quote:

"It's not hard to make decisions once you know what your values are." - Roy E. Disney

Before you go…

Let me thank you for investing your time to read this in its entirety. This is a non-exhaustive post. If you know about the sector, this is probably not for you. But I still urge you to poke holes in it and let me know what I got wrong.

Sayonara DCs. Till next time :)

Disclaimer:

This post is not in any way intended to promote 100% veganism and judge the non-vegetarians. The objective is to share the current status of the alternative protein sector and the strong trajectory it is witnessing.

The closing section mentioned is my personal view and doesn’t hold any kind of advice.

[1] Kearney research

[2] FAO

[3] ORFonline.org

[4] thelancet.com

[5] Downtoearth.com

[6] Waterfootprint.org

[7] GFI

[8] Kearney research

[9] Bloomberg

[10] Kearney research

[11] Redseer

[12] Good Food India

[13] Nirmal Bang report

[14] Good Food India

[15] Research from multiple sources

[16] Redseer

[17] Redseer

[18] Wallstreetjournal

[19] Indianretailer.com